Where the U.S. Housing Market Sits in the Economic Cycle Today

Understanding Today’s Market Through the Lens of J Scott’s “Recession-Proof Real Estate Investing”

Real estate moves in cycles, and knowing where we are in that cycle is one of the most powerful tools buyers, sellers, and investors can have. Using the framework from J Scott’s Recession-Proof Real Estate Investing, this blog breaks down current housing data and explains exactly where the United States likely sits in the economic cycle—and what it means for you.

📉 What Today’s Real Estate Data Is Telling Us

Across the country, we’re seeing a noticeable shift in the housing landscape. It’s visible not just in price tags and headlines — but in real market data.

Home-Price Growth Has Slowed Significantly

According to the most recent data from Federal Housing Finance Agency (FHFA), home prices rose only about 2.2% year-over-year in Q3 2025. HousingWire+2FHFA.gov+2

This slow growth represents a major deceleration compared to the steep annual gains during the post-pandemic boom years — a clear signal that the overheated appreciation phase is cooling off.

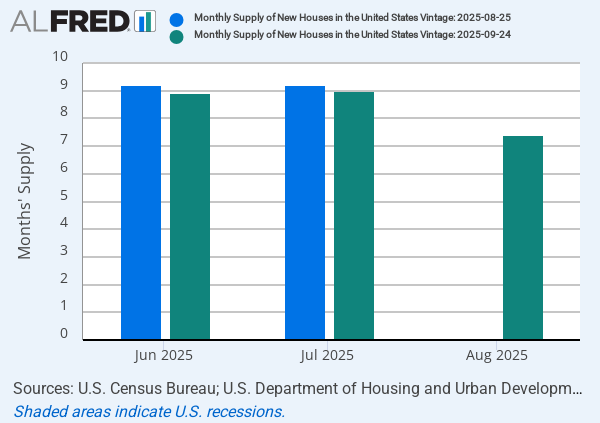

Inventory Is Rising Across the U.S.

Nationally, active housing-inventory levels have been climbing for months. As of October 2025, data shows inventory rising for the 24th straight month. Realtor+2Realtor+2

More supply means more choices for buyers — a big shift from the constrained, frenzied market of the past few years.

Homes Are Taking Longer to Sell

A key barometer of market pace — how long homes stay on the market — is rising. According to data from Realtor.com, the median days on market reached 63 days in October 2025, marking the 19th consecutive month of year-over-year increases. Realtor+1

That tells us buyers are no longer racing — they’re pacing themselves, which often signals a shift from a seller’s market toward a more balanced (or buyer-friendly) market.

🔄 Mapping Today’s Market to the Real Estate Cycle

Using the four-phase cycle from J Scott — Expansion → Peak → Recession/Reset → Recovery — the data above suggests the U.S. housing market is now transitioning out of Peak and entering a Reset / Cooling phase.

Signs That We Are Just Past Peak:

-

Price growth has significantly decelerated.

-

Inventory has been rising for nearly two years.

-

Homes are lingering longer on the market, and sellers are seeing less urgency from buyers.

-

Price cuts and increased negotiation leverage are more common. The Independent+2Realtor+2

This isn’t a crash — it’s a clearing of the overheated air. It’s a reset.

If you were to draw a long-term graph of home-price index + inventory + market velocity, you’d likely see a plateau or slight downward slope — consistent with a cooling phase after a boom.

🏘 What This Means for Investors

For thoughtful investors — especially those focused on long-term value and cash flow — this phase can be a strategic sweet spot:

-

Competition softens. Fewer bidding wars and less frenzied demand create space for rational decisions.

-

Pricing becomes more realistic. With more inventory and longer market times, buyers can negotiate and find deals at or below market value.

-

Cash-flow-oriented strategies win. When appreciation slows down, rent income and yield matter more than price-flipping.

-

Opportunity to buy quality assets. Markets correct — and corrections often hide gems for the disciplined investor.

If you’re investing with conservative underwriting, adequate reserves, and a long-term outlook — just like J Scott recommends — this cooling market may present your best buying window yet.

👩💼👨💼 Why the Right Real Estate Agent Matters in Every Cycle

Whether you’re buying or selling, the current cycle matters. And having an experienced local agent can make a huge difference in timing, strategy, and outcome.

An agent who understands:

-

Market timing — when to buy, when to list, when to hold

-

Local conditions — how inventory, demand, and pricing behave in your region

-

Negotiation strategy — how to price and present a property so it sells even when buyers are cautious

-

Long-term planning — how to invest for cash flow, appreciation, or future resale

... can help you navigate any cycle with confidence and clarity.

If you're buying, selling, or investing — that’s where Ehrin & Caleb Fairey come in.

Based in Augusta/Evans, they bring local insight + cycle-aware strategy + a heart for service. Whether the market is scorching hot or cooling down, they’ll help you make smart, grounded decisions.

✨ Final Thoughts

The U.S. housing market is clearly moving out of its overheated phase and entering a more balanced — more thoughtful — season. In times like these, smart strategy matters more than speed. Numbers matter more than hype.

If you want to buy, sell, or invest — especially in Augusta or Evans — and want guidance tailored to where the market is today (not yesterday), Ehrin & Caleb Fairey would be honored to walk with you.

Ehrin Fairey Real Estate

Real Estate That Gives Back

Thoughtful guidance. Data-backed strategy. A commitment to service — no matter where we are in the market cycle.